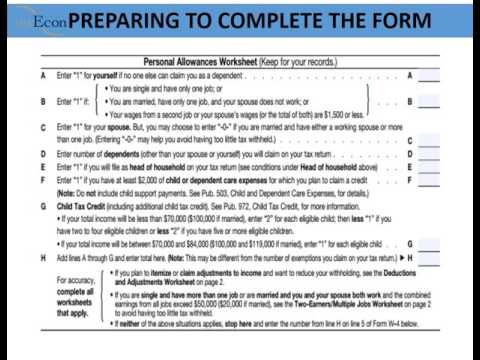

Good evening, my Connors. If you are watching this video, this is actually your first step in my econ, taking care of your personal finances and becoming more successful with it. I am Clarissa Pace, EVP gold and leader of the my econ vision team in Southeast Arkansas. But don't let Southeast Arkansas limit you because we have members as far as Germany. So, we're excited about that. Now, I want you to understand this part because it is crucial to your financial recovery. In 2000, it was updated by RS in 2005 that individual working individuals were actually paying at least $40 a week too much on their taxes due to incorrectly completing the W-4 form. In my econ, we aim to increase your cash flow by educating you on this form. Some of you may not see an increase if you have filled out the form correctly. However, some people believed in myths, such as putting all zeroes on the form, or simply lacked understanding about it and didn't complete it correctly. We don't know how your personal outcome will be, but if you are losing in this area, we hope you will benefit from taking a look at the W-4 form. If you have been completing it properly, it will give you an opportunity to understand why you have been doing so and why you are in a great position in terms of income. Let me give you a personal testimony. When my husband and I became a part of my econ and learned about this form, we realized that we were actually losing $800. We were excited to change our W-4 forms and get that money back into our household. This meant that we increased our cash flow by $12,000 annually. We were able to afford life enhancements like...

Award-winning PDF software

W-4 allowances worksheet Form: What You Should Know

How to calculate the expected Delaware income tax withholding allowances on your Form IL-W-4? Complete the Delaware income tax withholding calculator and give the worksheet to your boss.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS W-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS W-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS W-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS W-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-4 allowances worksheet