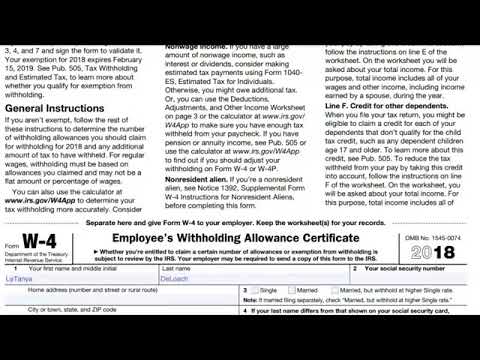

Hello, hello, hello! This is Latonya, an MS coach for Deloatch. So, come right on in. I want to share with you the income shifting strategies for the associates and youth of my econ. I have a lot of new people signing up this week, so it's important to discuss and understand how this works. Let's start with our 2018 W-4 line A. The first thing to understand is that many people claim exemptions on this W-4. However, if you pay close attention, it says "allowances," not exemptions. Often, people mistakenly assume that one allowance is equivalent to one exemption for themselves, their spouse, and each child. This confusion leads to overpaying the IRS, as about 8% of people do. Overpaying means you receive less from your paycheck. The IRS recommends revisiting your W-4 form every year because your status can change - from married to single to divorced. You need to check if any of your allowances have changed. Let's focus on line A and its options. If you're filing as "single," enter one for yourself. If you're found married filing jointly, enter one. If you're filing as married filing separately or as head of household, do not enter one. Instead, enter the appropriate status based on your situation. Now, let's take a look at line E and see what qualifies someone for head of household status. Please note that you can claim head of household filing status on your tax return if you are unmarried and pay more than 50% of the expenses to keep up a home for yourself and a qualifying individual. For example, at the beginning of 2018, I was legally married, but I got divorced in May 2018. My status changed to head of household because my daughter, who is in college, is a qualifying dependent. So, for myself,...

Award-winning PDF software

2018 w4 tax Form: What You Should Know

Business Use Tax Annual Return MN-W4, Use Tax Allowance Certificate and Instructions. 5083, 2025 Business Use Tax Annual Return MO-W4, Use Tax Allowance Certificate and Instructions. 5203, 2025 Income Tax Return (With interest) for Individuals Income Tax Return for Individuals (W-4) (Form 2555) for 2018. 5204, 2025 Income Tax Return (With Interest) for Taxpayers with Net Investment Income (Iris) Income Tax Return for Taxpayers with Net Investment Income (Iris (PDF, 0.3 MB) N/A. 5203E, Special Tax Examination — Exemption Certificate (Form M315) for Michigan Taxpayers with Net Investment Income. 5205, 2025 Annual Return for Federal Business Entity Income Tax Return for Federal Business Entity (Form 2555) (PDF, 3.1 MB). 1040, 2025 Federal Tax Return. 1040A, 2025 Federal Tax Return for FICA Filing Year (Form 1040). 1040G, 2025 Federal Tax Return with interest. 1040H, 2025 Federal Tax Return with interest (Form 1040A-EZ) for Federal Tax Year 2018. 1510P, 2025 Individual State Income Taxes Return, With Interest. Michigan's law allows Michigan taxpayers to get a State Income Tax Return and interest in completing a 1510P.pdf, on, and, on, and, on, and, on. 2018 Federal Withholding Allowances (W-4) 2017 Form W-4 Tax and Wage Information Return (FEDS 1550-1). See Also.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS W-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS W-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS W-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS W-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 w4 tax form