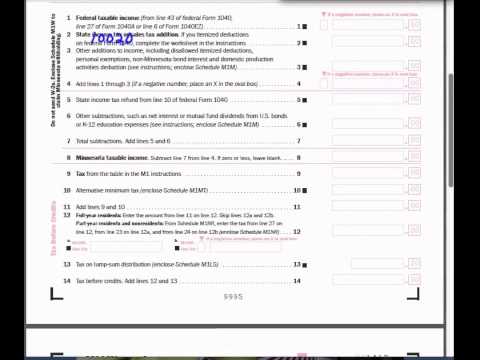

This is the final video for our income tax unit. It will be a step-by-step process in completing the Minnesota individual tax reform form M1. This project is done for Sarah Walker's Minnesota income tax. To complete this process, I suggest having the W-2 form handy and a copy of your federal 1040 EZ, as we will be referencing a couple of places in that document. To start, we will fill out the top section of the form. Then, I will erase that information and scroll down to give you the entire view of the screen. We will input Sarah's name, social security number, and current home address. Since there is not a joint return, the next section will be left blank. Moving on, we will fill in Sarah's date of birth. As Sarah is single, we will check the representing single. She does not elect to do any political campaign contributions or deductions, so we will leave that section blank. Now, let's scroll down to the income section of the form. Here, we need to record information about Sarah's wages and salary. In letter A, it asks for wages, tips, and salary, which will come from the W-2. Sarah earned $10,020 in income. She had no contributions from an IRA or unemployment, so those sections will be left blank. The federal adjusted gross income can be found on line number four of the 1040 EZ, which was $10,820. The $800 difference in these two numbers accounts for the interest she received from her savings account, which we will put in letter D. Next, we move on to the federal income taxable income, which comes from line number six on the 1040 EZ. That number is $4,620. As for item number two, we have no information to record for state income tax or...

Award-winning PDF software

Mo w-4 Form: What You Should Know

Form MO W-4 is completed, so you can have as much “take-home pay” as possible without an income tax liability due to the state of Missouri when you file your Federal income tax return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS W-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS W-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS W-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS W-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Mo w-4